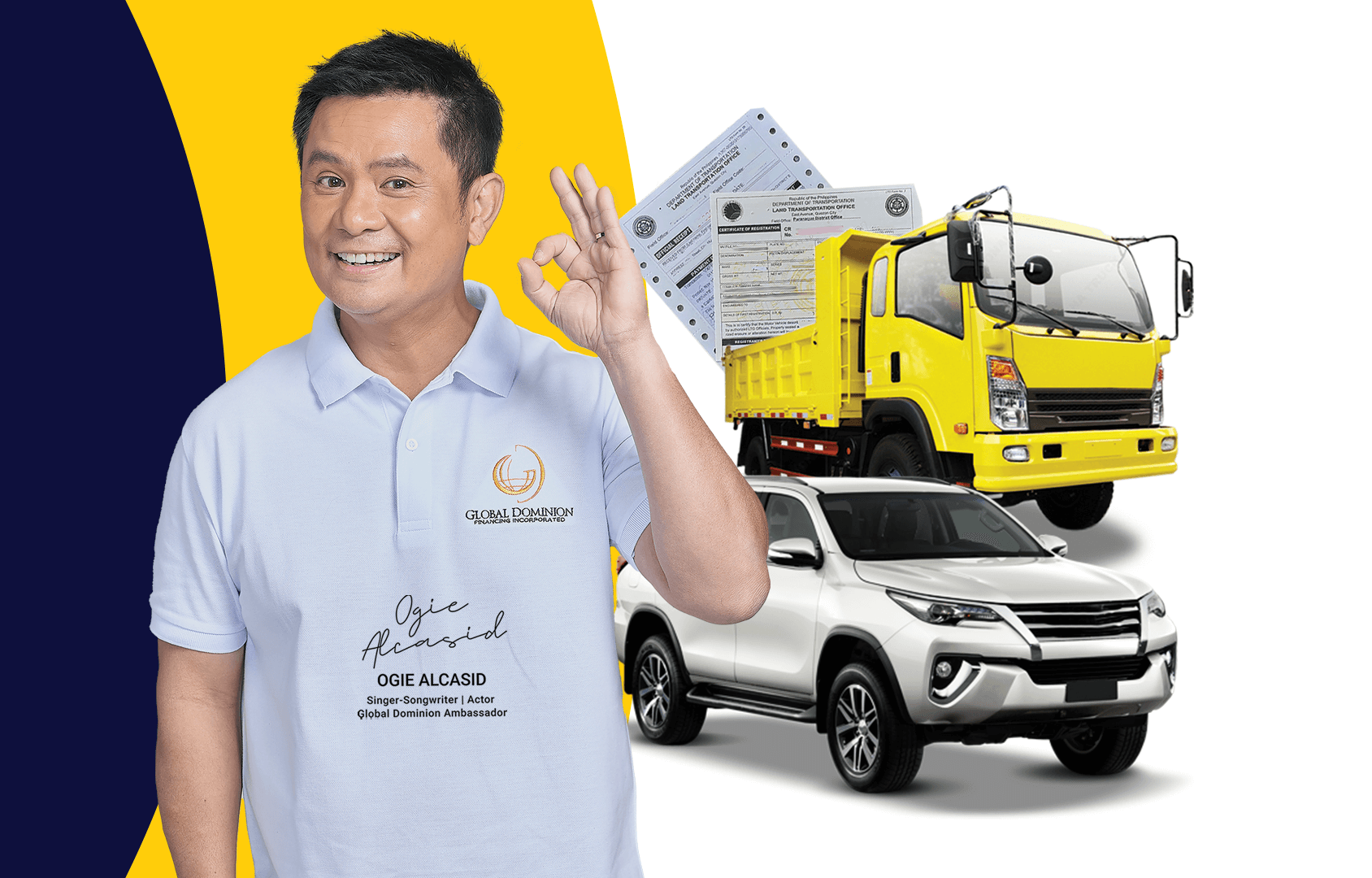

When financial emergencies strike, many Filipinos look for fast and practical solutions to cover their urgent needs. One option that has gained ORCR sangla loan in recent years is the ORCR Sangla Loan—a type of loan where vehicle owners use their car’s Official Receipt and Certificate of Registration (OR/CR) as collateral while still being able to use their vehicle. Compared to traditional bank loans, this financing option offers speed, convenience, and flexibility, making it the go-to choice for many.

What is an ORCR Sangla Loan?

An ORCR Sangla Loan allows car owners to access quick cash by pledging their car’s documents as security. Unlike traditional loans that often require lengthy processing and credit checks, this type of loan is much faster and requires fewer requirements. Borrowers can continue driving their car while benefiting from instant funds.

Why Filipinos Prefer ORCR Sangla Loans

1. Fast Approval and Release of Funds

In times of emergencies, speed matters. With ORCR Sangla Loans, approval can take just a few hours to a day, and cash is released almost instantly compared to bank loans that may take weeks.

2. No Need to Surrender Your Car

One of the biggest advantages is that borrowers can still use their vehicle while paying off the loan. Only the OR/CR documents are pledged, giving people financial flexibility without disrupting their daily routine.

3. Less Stringent Requirements

Traditional loans often require high credit scores, proof of income, or extensive paperwork. With an ORCR Sangla Loan, requirements are simpler—usually just valid IDs, proof of billing, and the car’s OR/CR documents.

4. Accessible to More Borrowers

Many Filipinos who don’t qualify for bank loans due to lack of credit history or collateral find ORCR Sangla Loans more accessible. This makes it a lifeline for self-employed individuals, small business owners, and those with irregular income.

5. Flexible Loan Amounts

The loanable amount depends on the vehicle’s market value, giving borrowers flexibility to get the funds they need—whether for medical expenses, business capital, or emergency bills.

The Bottom Line

Filipinos are turning to ORCR Sangla Loans because of their speed, ease, and accessibility. It’s a practical option for anyone who needs quick cash without the hassle of traditional lending. However, like any financial product, borrowers should choose licensed lenders and understand the terms to avoid unnecessary risks.

By offering fast cash without giving up their cars, ORCR Sangla Loans continue to be one of the most trusted financial solutions for many Filipinos today.